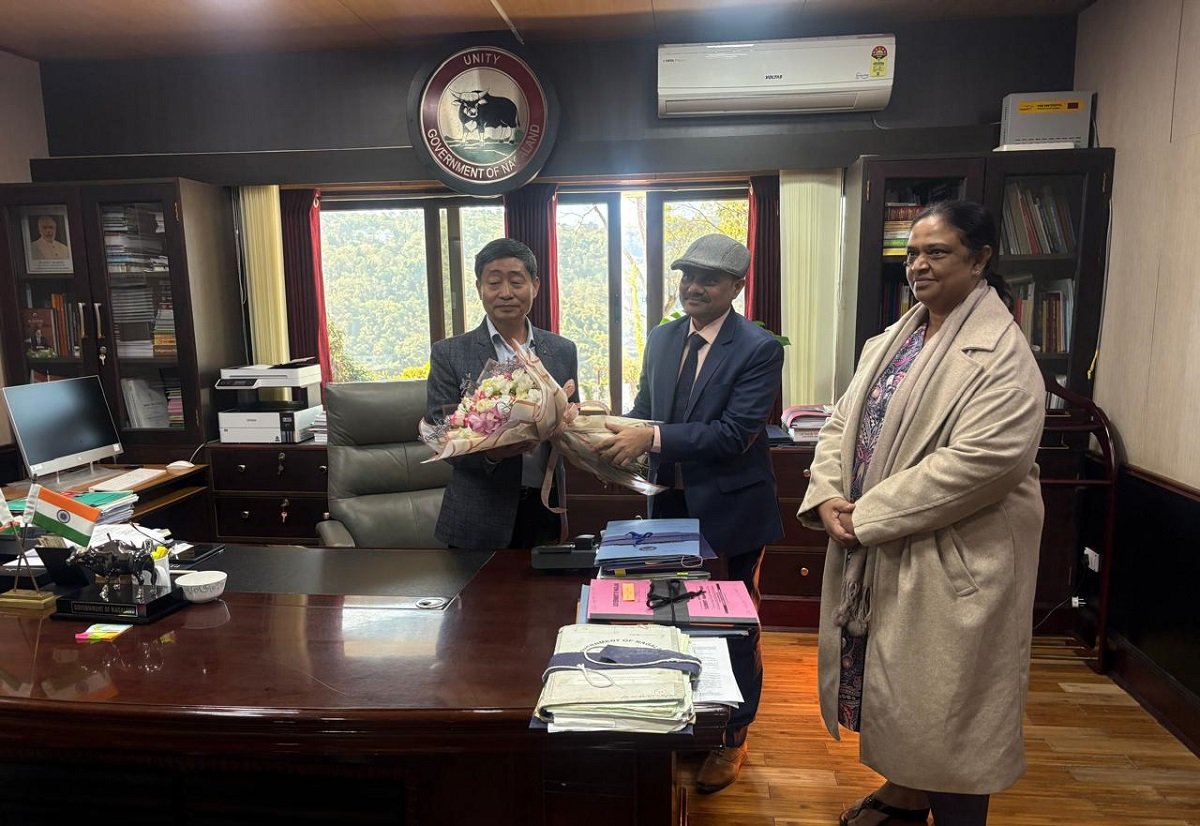

Bank of Baroda (Bank), one of India’s leading public sector banks, partnered with the Government of Nagaland for the Hornbill Festival 2025 held from 1st to 10th December 2025 at the Kisama Heritage Village, near Kohima. This association underscores Bank of Baroda’s continued efforts to support regional growth and development in Northeastern India, particularly in the state of Nagaland. An engagement stall put up by the Bank was inaugurated by Shri Temjen Imna Along, Honourable Minister of Higher Education & Tourism, Government of Nagaland in the presence of Dr. Debadatta Chand, Managing Director & CEO, Bank of Baroda along with Ms. Beena Vaheed, Executive Director, Bank of Baroda and Shri Shiba Pada Nayak, Zonal Head – North Eastern States, Bank of Baroda. Shri Veyielo Doulo, Director of Tourism and Shri Toka E. Tuccumi, Joint Director of Tourism were also present on the occasion. The comprehensive engagement stall offered product information, digital banking demos and facilitated direct interaction with artisans, entrepreneurs, tourists and community groups. These efforts align with the Government’s vision of promoting financial literacy, encouraging digital payments, fostering grassroots entrepreneurship and expanding formal financial access across Nagaland.

On the occasion, Dr. Chand and Ms. Vaheed met Shri Jyotiraditya M. Scindia, Honourable Union Minister of Communications and Minister for Development of North Eastern Region (DoNER), and discussed avenues to deepen the Bank’s engagement in the North East through improved Financial Inclusion. The Nagaland State Government invited Dr. Chand and Ms. Vaheed as State Guests. They were also felicitated on the 6th day of the event in the Hornbill Festival 2025.

Speaking on the occasion, Dr. Debadatta Chand, Managing Director & CEO, Bank of Baroda said, “Bank of Baroda’s partnership for the Hornbill Festival 2025 reflects our strategic focus on advancing credit flow, deepening financial inclusion, accelerating branch expansion, and fostering sustainable socio-economic growth in Nagaland and North East India. With plans to expand our branch network alongside the new Guwahati Zonal Office, we aim to empower local communities through improved access to credit, digital banking, and tailored financial solutions that drive entrepreneurship, employment, and inclusive prosperity.”